city of richmond property tax calculator

Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in order of median property taxes. This utility allows a person to interactively search the City of Richmond real property database on criteria such as Parcel ID Address Land Value Consideration Amount etc.

Securitization Audit Stops Foreclosure Buying A Foreclosure Foreclosed Homes Foreclosures

City of Richmond adopted a tax rate City of Richmond City Hall 402 Morton Street Richmond TX 77469 281 342-5456 Website Design by Granicus - Connecting People and Government.

. 04 on the value of your property above 4 million. 3 Road Richmond British Columbia V6Y 2C1 Hours. City of Richmond Real Estate Search Program.

City of Richmond 2019 and newer property taxes real estate and personal property are billed and collected by the Ray County Collector. The median property tax also known as real estate tax in Richmond city is 212600 per year based on a median home value of 20180000 and a median effective property tax rate of 105 of property value. These documents are provided in Adobe Acrobat PDF format for printing.

Real property tax on median home. Richmond Property Tax Calculator. Richmonds new Virtual City Hall now provides for more business taxpayer and visitor needs online.

The City of Richmond Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within City of Richmond and may establish the amount of tax due on that property based on the fair market value appraisal. These agencies provide their required tax rates and the City collects the taxes on their behalf. Restaurants In St Cloud Mn Open For Thanksgiving.

City Council placed a measure on the November 3 2020 ballot that was approved by the voters which changes the Business Tax calculation methodology to be based on gross receipts in the City of Richmond instead of the number of employees. This utility allows a person to interactively search the City of Richmond real property database on criteria such as Parcel ID Address Land Value Consideration Amount etc. The current millage rate is 4132.

What Is The New Car Sales Tax In San Antonio Texas. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. To pay your 2019 or newer property taxes online visit the Ray County Collectors websiteAll City of Richmond delinquent taxes 2018 and prior must be paid to the City of Richmond Collector prior to paying 2019 or newer property taxes to the Ray.

The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. City millage rate based on the house value of 250000 for select years. The results of a successful search will provide the user with information including assessment details land data service.

City of richmond property tax calculator. Richmond City collects on average 105 of a propertys assessed fair market value as property tax. Access services get information pay online and more.

California city documentary and property transfer tax rates governance. To contact City of Richmond Customer Service please call 804-646-7000 or. Home City Hall Finance Taxes Budgets Property Taxes Tax Rates.

Beginning january 31 2021 interest on unpaid taxes will be applied monthly. Option 1 Search by Your Street Address. Your annual property taxes collected by the City of Richmond funds municipal services and other taxing agencies such as the Province of BC School Tax TransLink BC Assessment Authority Metro Vancouver and the Municipal Finance Authority.

Italian Restaurant Detroit Lakes Mn. A 5 million detached home would have to pay an additional school tax of 6000 in 2020. 02 x 1M 2000 Value between 3M and 4M 04 x 1M 4000 Value above 4M Total.

You can call the City of Richmond Tax Assessors Office for assistance at 804-646-5600Remember to have your propertys Tax ID. The results of a successful search will provide the user with information including assessment details land data service information planning and governmental specifics. This property tax calculator is intended to be used by residential property owners to obtain an estimate of their property taxes by year.

Richmond city collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. A 5 Million Assessed Value Detached Home in 2020. Without Senior Discount Applied.

This tool is not designed for use with multi-residential farm forest or business properties. Para solicitar una traducción llame al centro de servicio al cliente de la Ciudad de Richmond al 804-646-7000 o 3-1-1. The City of Richmond is inviting residents to apply to be part of the Richmond Resident Advisory Council RAC a group which will help shape the Citys 6th cycle Housing Element Update and Housing Equity Roadmap.

City of Richmond Assessors Office Services. Lauras Income Tax Services El Monte. 815 am to 500 pm Monday to Friday.

Falls Church city collects the highest property tax in Virginia levying an average of 600500 094 of median home value yearly in property taxes while Buchanan County has the lowest property tax in the state collecting an average tax. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. City of richmond property tax calculator Wednesday March 30 2022 Edit.

Conducting your city business online is quick and easy. You can also type it find it from the upper right hand corner of any page on the citys website. Sales Tax State Local Sales Tax on Food.

Examples are shown below with and without seniors discount. Calculating Your Richmond Hill Property Tax Due. The city of richmond is located south of vancouver in the metro vancouver regional district and is home to over 198k residents.

Tax information for these property types can be obtained by contacting Richmond Hill directly at the number below. Ad Find Out the Market Value of Any Property and Past Sale Prices. When contacting City of Richmond about your property taxes make sure that you are contacting the correct office.

Homes For Sale Due To Foreclosure Read More Http Readyrealtyllc Wordpress Com 2012 12 03 Homes For Sale D Foreclosed Homes Foreclosures Bank Owned Homes

15 Safest Housing Markets If A Recession Hits National Mortgage News Housing Market Job Security Marketing

Adian Proactively Works With Clients Towards Ensuring That Your Tax Liability Is Optimized And Appropri How To Plan Business Consultant Services Tax Consulting

These 6 Ontario Cities Currently Have The Lowest Property Tax Rates In The Province Ontario City The Province Real Estate Buying

These Tropical Floating Bars Are Hiring In Ontario You Can Make Up To 25 An Hour In 2022

Vancouver Market Affected By Bc Foreign Buyer Tax In July 2016 Vancouver Vancouver Real Estate Marketing

Pin On Houston Home Buyers Seminars

305 West Washington Street Cool Kitchens Real Estate Outdoor Structures

Climate Aiken South Carolina And Weather Averages Aiken Chelan Chelan Washington South Carolina

Following A Recent Council Approval Canadian City Of Richmond Hill Will Be Exploring Providing Crypto Asset Pr Property Investor Property Tax Mortgage Payment

3570 Strandherd Drive Unit 8 Nepean Ontario K2j5l4 Ottawa Ontario Waterfront Property Toronto Ontario

Richmond Hill Property Tax 2021 Calculator Rates Wowa Ca

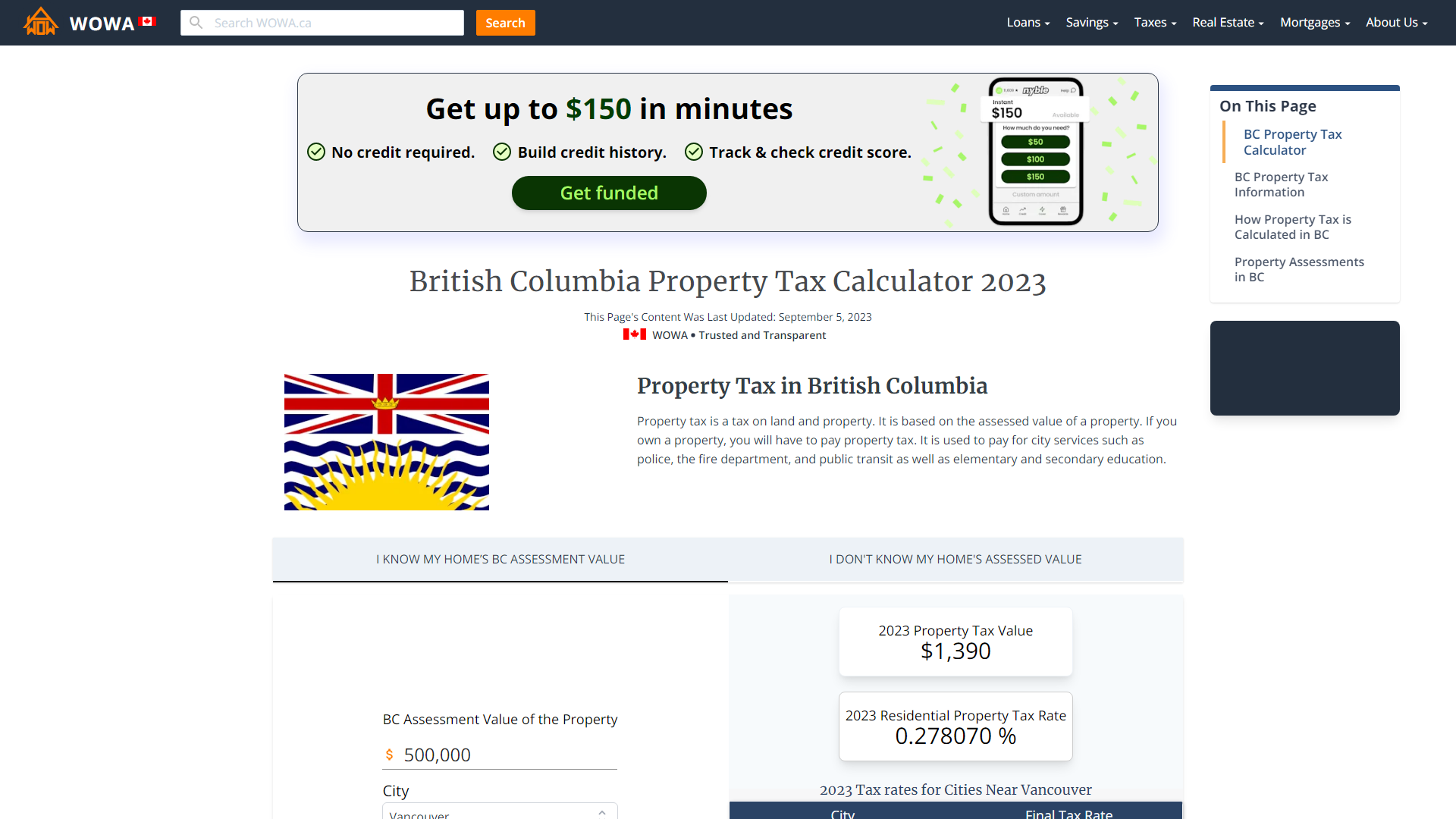

British Columbia Property Tax Rates Calculator Wowa Ca

This Huge 720k Ontario Home Has 11 Rooms Is Surrounded By Wineries Photos In 2022 Cottage Core Aesthetic Historic Properties Real Estate

Please Help Us Welcome Sheryl Johnson To Coldwell Banker Residential Brokerage Feel Free To Stop By The Foothills Offi Coldwell Banker Banker Lake Havasu City

Real Estate Professionals Flipping Houses Real Estate Professionals Real Estate